BNP Paribas Fortis is now offering real-time bank account aggregation

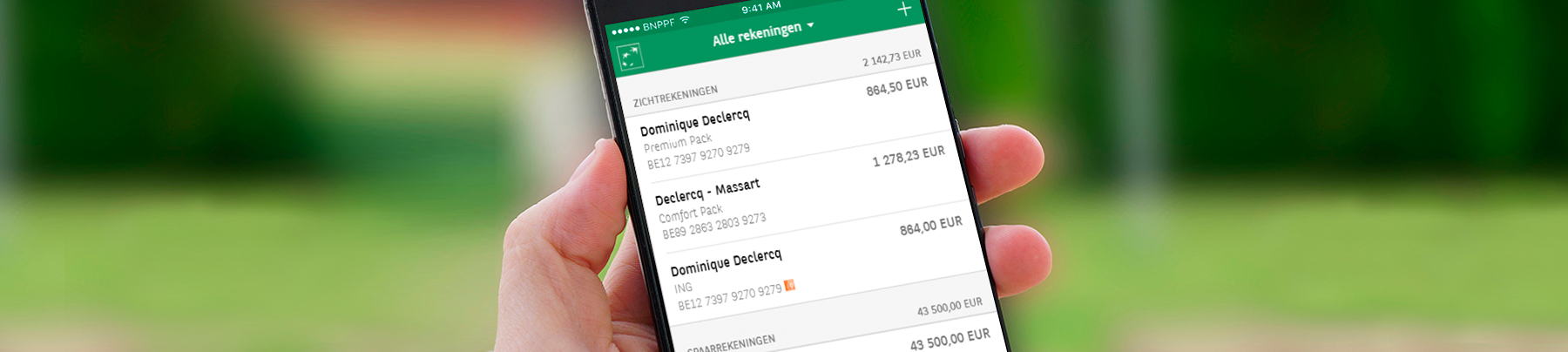

BNP Paribas Fortis is launching the multi-bank version of its Easy Banking App, available for iPhone and Android smartphones. Using this innovative and secure tool, customers can consult balances and past transactions across all their current and savings accounts held with a number of financial institutions.

Giving customers a single overview of their various bank accounts, regardless of the bank they are held with: this is the challenge that BNP Paribas Fortis set itself, in partnership with Swedish fintech Tink. The reason for taking up this challenge is that bank account aggregation services are a good way of meeting the demand among our customers for services that are simple and easy to use. BNP Paribas Fortis is therefore delighted to offer, from today, a new function allowing customers to view information from all of their bank accounts – held with BNP Paribas Fortis and other financial institutions – on a single screen on the Easy Banking App.

Viewing accounts in real time

This secure service allows customers to consult, using a single app, the exact overall balance of their current and savings accounts held with various financial institutions, along with past transactions, in real time. It is the first of its kind in Belgium.

In a single glance, customers can access all the information they need about their personal and business accounts. The days when they had to download files and juggle information between different mobile apps specific to each bank are now over.

Accounts held with Belfius, ING and KBC can now be added to the Easy Banking App. In the next few months, the BNP Paribas Fortis account integrator will expand to cover other banks and will add functions such as payment initiation and Personal Finance Management.

“Account aggregation adds real value for our customers, who will be able to bring information from all their accounts held with various banks together in a single app,” said Michael Anseeuw, head of Retail Banking at BNP Paribas Fortis. “Today, one in four BNP Paribas Fortis customers also has an account with another bank. This new function forms part of our broader ambition to improve the user experience and provide customers with innovative new services that make their day-to-day lives easier, in the context of the EU’s new Payment Services Directive.”

How to add an external account to the Easy Banking App

After accepting the Easy Banking App’s general terms and conditions of use, customers can add other accounts simply by selecting the relevant bank, entering their user ID and password for that bank and linking the relevant card reader.

To make things even easier, once customers have entered their external bank details, they no longer have to use card readers or cards for those external banks to obtain an account overview. With BNP Paribas Fortis, customers can now consult all of their bank accounts in real time.