BNP PARIBAS FORTIS AND VISA LAUNCH VISA DEBIT IN BELGIUM

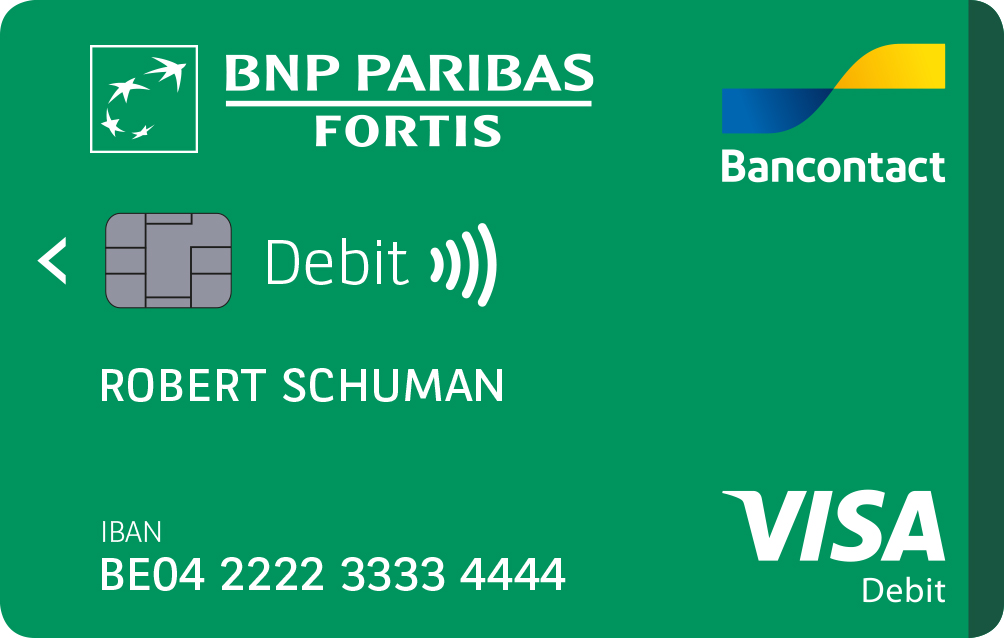

BNP Paribas Fortis and Visa are introducing Visa Debit into the Belgian market for the first time. With Visa Debit, BNP Paribas Fortis is strengthening its position in the payments market by offering its customers an innovative debit card that provides an optimal user experience and wider accessibility. The cards are accepted by both physical and online stores worldwide.

The current pandemic and lockdowns have had a significant impact on the way we pay for goods and services. The crisis has brought to light certain trends among our customers, who are using their cards more frequently to carry out purchases in shops, online transactions (67% increase between 2019 and 2020) and contactless payments (325% increase between 2019 and 2020).

It is against this background that BNP Paribas Fortis – which already offers a comprehensive range of innovative payment solutions, comprising Apple Pay, Google Pay, Fitbit Pay, Garmin Pay and Payconiq by Bancontact, free of charge to all its customers in Belgium – is introducing Visa Debit, the debit card for all everyday purchases, into the Belgian market. From now on, Visa also offers consumers the possibility of having a debit card in Belgium.

Worldwide acceptance, both online and in-store

The new Bancontact-Visa Debit benefits from a large payment network, and will be accepted in Belgium, Europe and around the world at several million merchants, both in-store and online. This new debit card can be used wherever the Visa logo appears.

Visa Debit forms part of our efforts to develop innovative services for our customers:

- Online purchases can be confirmed in a user-friendly way using biometrics;

- Card management options (reviewing purchases, temporarily blocking the card, adjusting limits, changing its PIN etc.) will be further expanded within Easy Banking App and Easy Banking Web;

- Our customers will be able to use virtual cards (as opposed to a physical bank card) to use online or via smartphones and wearables.

"In Belgium, more than ever, the debit card is the one essential means of paying for everyday purchases,” said Michael Anseeuw, General Manager Retail Banking at BNP Paribas Fortis. “Our new Bancontact-Visa Debit card provides an optimal user experience thanks to almost universal acceptance in physical stores and online. With this innovation in the Belgian market, together with the new services available via our digital channels, we are offering the best solution for both offline and online payments.”

"Visa Debit is accepted in more than 200 countries and territories, by 70 million merchants, making it the most widely accepted debit card in the world,” added Jean-Marie de Crayencour, Country Manager Belgium and Luxembourg at Visa. "This is great news for Belgian consumers because Visa Debit will give them access to another payment method that is perfectly suited to their payment habits. We will be working on developing the Visa Debit offering in the coming months and years, so that more and more consumers can benefit from it.”

BNP Paribas Fortis customers do not need to take any action: they will automatically receive their new cards at no additional cost.

By the end of 2021, almost 4 million debit cards will be in use by our customers.

Press contacts - BNP Paribas Fortis :

Valéry Halloy

+32 (0)475 78 80 97

valery.halloy@bnpparibasfortis.com

Hilde Junius

+32 (0)478 88 29 60

hilde.junius@bnpparibasfortis.com

Press contacts - Visa :

Nicolas Daghero

+33 (0)6 85 55 05 05

dagheron@visa.com

Marlies Van Overstraeten

+32 (0)474 23 79 22

marlies.vanoverstraeten@finn.agency