Belgian exports to EU countries underperform compared with non-EU markets: BNP Paribas Fortis identifies untapped growth potential

For many products, exports from Belgium to other EU countries are noticeably weaker than exports to non-EU countries. Consequently, Belgian intra-EU exports are more than €10 billion lower than they otherwise would be. This is the conclusion of a BNP Paribas Fortis study, which visualises trade flows at product level. By making the results available, the bank aims to identify growth opportunities for Belgian companies.

Slideshow Belgian intra-EU export.pdf

PDF 3.0 MB

A 2025 study by the International Monetary Fund1 (IMF) shows that intra-European exports incur an average cost equivalent to an import tariff of 45%. Christine Lagarde, President of the European Central Bank, indicated at the end of last year2 that her institution will publish an analysis3 later this month suggesting a cost of up to 65%.

Belgian exports within the EU: untapped potential

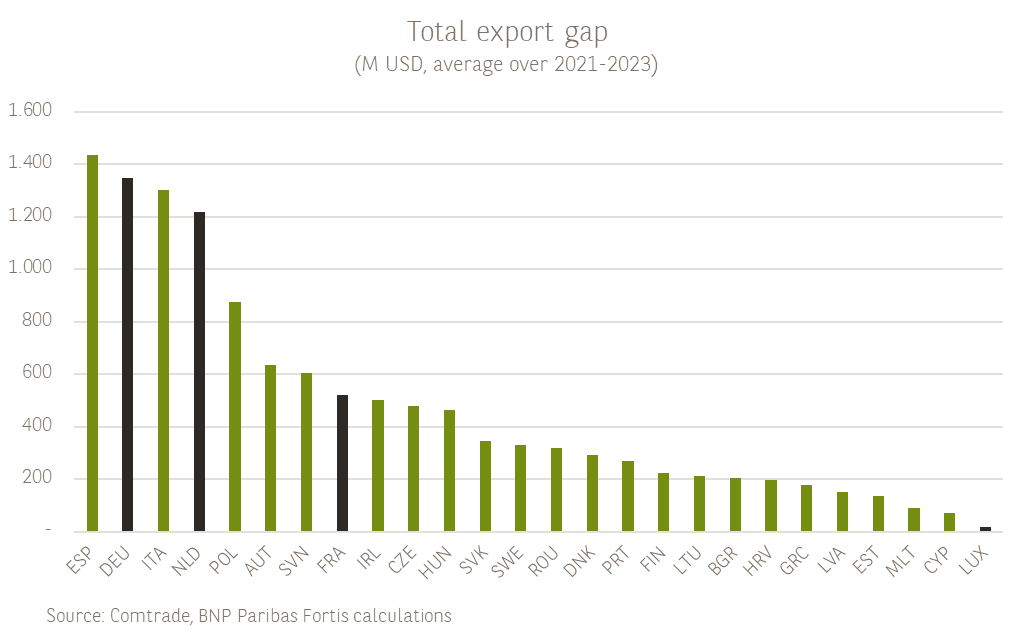

Using UN Comtrade data, BNP Paribas Fortis mapped Belgian goods exports in detail. For each product category, the bank compared the total market share of exports outside the EU with the market share of exports to each EU country. The bank then assessed whether the intra-European market share was at least as large as the non-European one. The conclusion is that Belgium is not making full use of its potential when it comes to intra-EU exports. In total, this represents a shortfall of more than €10 billion in exports to other EU countries that Belgium is missing out on.

“In principle, goods exports within the European Union benefit from advantages such as shorter distances, shared languages and a common currency,” says Arne Maes, Senior Economist at BNP Paribas Fortis. “Yet these advantages are not always reflected in the figures. We found that our country has low market shares in major economies like Germany, Spain and Italy in sectors such as organic chemicals, pharmaceuticals and specialised metals. Belgian exporters also perform strikingly poorly in the Netherlands, Poland and Slovenia.”

Mapping growth opportunities

Like ECB researchers, BNP Paribas Fortis acknowledges that the current situation is not solely the result of policy measures, such as strict labelling requirements for certain products. Recent academic research has shown that consumer preferences and stronger domestic networks can also play a role.

By mapping trade flows at a granular level, BNP Paribas Fortis aims to highlight growth opportunities. The analysis reveals which Belgian products have additional export potential and to which EU countries.

“This valuable information will enable the bank to better serve its clients, which could have a positive impact on the Belgian economy. Thanks to the analysis, European sales markets and barriers can be better understood, which could accelerate further European integration. It might even lead to a Belgian intra-European trade mission in the coming years,” concludes Arne Maes.

1 Adilbish, O, D Cerdeiro, R Duval, G H Hong, L Mazzone, L Rotunno, H Toprak and M Vaziri (2025), “Europe’s productivity weakness”, IMF Working Paper WP/25/40

2 Speech by Christine Lagarde at the 35th Frankfurt European Banking Congress, 21 November 2025 (https://www.ecb.europa.eu/press/key/date/2025/html/ecb.sp251121~bd4c7eacd0.en.html)

3 Bernasconi, R., Cordemans, N., Gunnella, V., Pongetti, G. and Quaglietti, L. (2025), “What is the untapped potential of the EU Single Market?”, Economic Bulletin, Issue 8, ECB. Expected publication date: 15 January 2026.